Lump Sum or Lifetime Income? Why You Might (or Might Not) Take the Big Check

If you’re facing the choice between a lump sum payout or monthly pension payments, you’re probably feeling the weight of the decision. After all, it’s not every day someone hands you a six- or seven-figure check and says, “It’s all yours.”

But before you grab that check and sprint to the nearest investment firm—or wave it off in favor of predictable monthly income—it’s worth taking a moment to think it through. Let’s explore both sides of the lump sum debate: why it might be the right move for you… and why it might not.

Reasons You Might Take the Lump Sum

1. Flexibility and Control

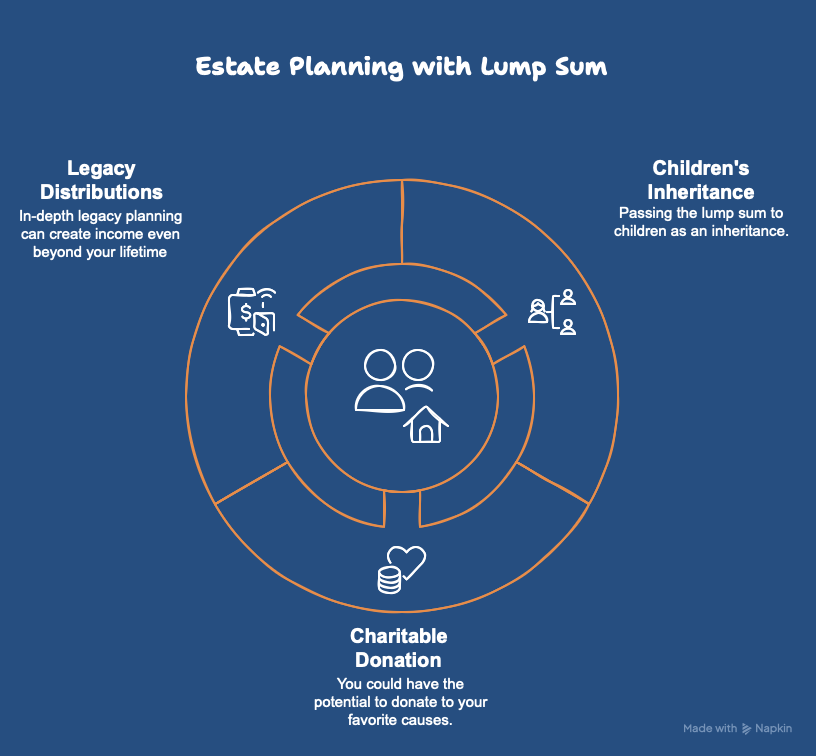

2. Estate Planning Advantages

3. Potential for Growth

4. Liquidity in an Emergency

5. Lack of Income Need

7 Tips to Maximize Your City of Jacksonville Pension

Unlock the full potential of your City of Jacksonville Pension with our free guide, “How to Maximize Your City of Jacksonville Pension.” Whether you're nearing retirement or in the peak of your career, this resource gives you tips to maximize your pension benefits in simple terms and shows you how to make smart, informed decisions. Learn how to increase your payout, avoid common mistakes, and confidently plan for a secure financial future. Don’t leave money on the table—get the clarity you need to make the most of your hard-earned benefits.

Reasons You Might Not Want the Lump Sum

1. Early Retirement

If you're retiring younger than most, that lump sum needs to stretch over a longer period—sometimes 30 years or more. That puts pressure on your investment strategy and withdrawals. A pension, on the other hand, provides guaranteed income right away, which can ease the burden of drawing from your savings too early or too aggressively. It’s a bit like having a steady drip of water when you're unsure how long the hike will be—there’s comfort in knowing it won't run out anytime soon.

2. Sequence of Return Risk

This one’s sneaky. If markets dip early in your retirement and you’re pulling a healthy percentage out of your investments, your nest egg may shrink faster than expected. That’s called sequence of return risk. Pensions protect you from this by giving you consistent income no matter what’s happening in the market—even if it's having a full-blown meltdown. And while long-term investors may recover, early retirees taking significant withdrawals during a downturn can see permanent damage.

3. Lack of Confidence in Spending Slowly

Not everyone feels confident managing a big pool of money over decades. Some retirees underspend out of fear, while others overspend too soon. If you know yourself and prefer a steady “paycheck” to keep things on track, monthly pension payments offer built-in discipline without needing to micromanage your budget. It removes the guesswork from retirement income and replaces it with the consistency of a paycheck you can count on.

4. Mismanaged Taxes

Lump sum distributions can create tax headaches if handled improperly. A poorly executed rollover or an overly aggressive withdrawal strategy could lead to unnecessary taxes—or worse, penalties. Without proper planning, what looked like a windfall could quickly shrink under the weight of IRS obligations. Working with a financial advisor or tax professional is essential if you want to avoid unintentional tax traps and make the most of your money.

5. Market Aversion

Let’s be honest—investing isn't everyone’s cup of tea. If the thought of watching markets rise and fall makes your stomach churn, or you just don’t want to deal with learning the ins and outs of investing, a guaranteed pension check can give you peace of mind without the volatility or mental stress. Some people enjoy managing their portfolio like a part-time job; others would rather not think about it at all. If you’re in the latter camp, the simplicity of a pension might feel like a breath of fresh air.

So... Which Path Is Right for You?

There’s no one-size-fits-all answer here, and that’s okay. Your financial goals, personality, health, and even your legacy wishes all play into the decision. If you’re someone who thrives on flexibility, likes having control, and has a solid plan (or partner) for investing, the lump sum could be a fantastic fit. But if you value stability, predictability, and freedom from financial stress, sticking with the monthly income may give you a better retirement experience.

Ready to talk through your options?

This is a big decision—and you don’t have to make it alone. The right strategy is the one that reflects your lifestyle, not just the math on a spreadsheet. If you’d like help walking through the pros, cons, and how each option fits your bigger picture, let’s talk. Retirement is a new beginning—let’s make sure it starts strong.

Check the background of your financial professional on FINRA’s BrokerCheck.

Securities and investment advisory services offered through Osaic Wealth, Inc. member FINRA / SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

This communication is strictly intended for individuals residing in the state of Florida. No offers may be made or accepted from any resident outside the specific state(s) referenced.

This site is published for residents of the state of Florida and is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security or product that may be referenced herein. Persons mentioned on this website may only offer services and transact business and/or respond to inquiries in states or jurisdictions in which they have been properly registered or are exempt from registration. Not all products and services referenced on this site are available in every state, jurisdiction or from every person listed. © 2024